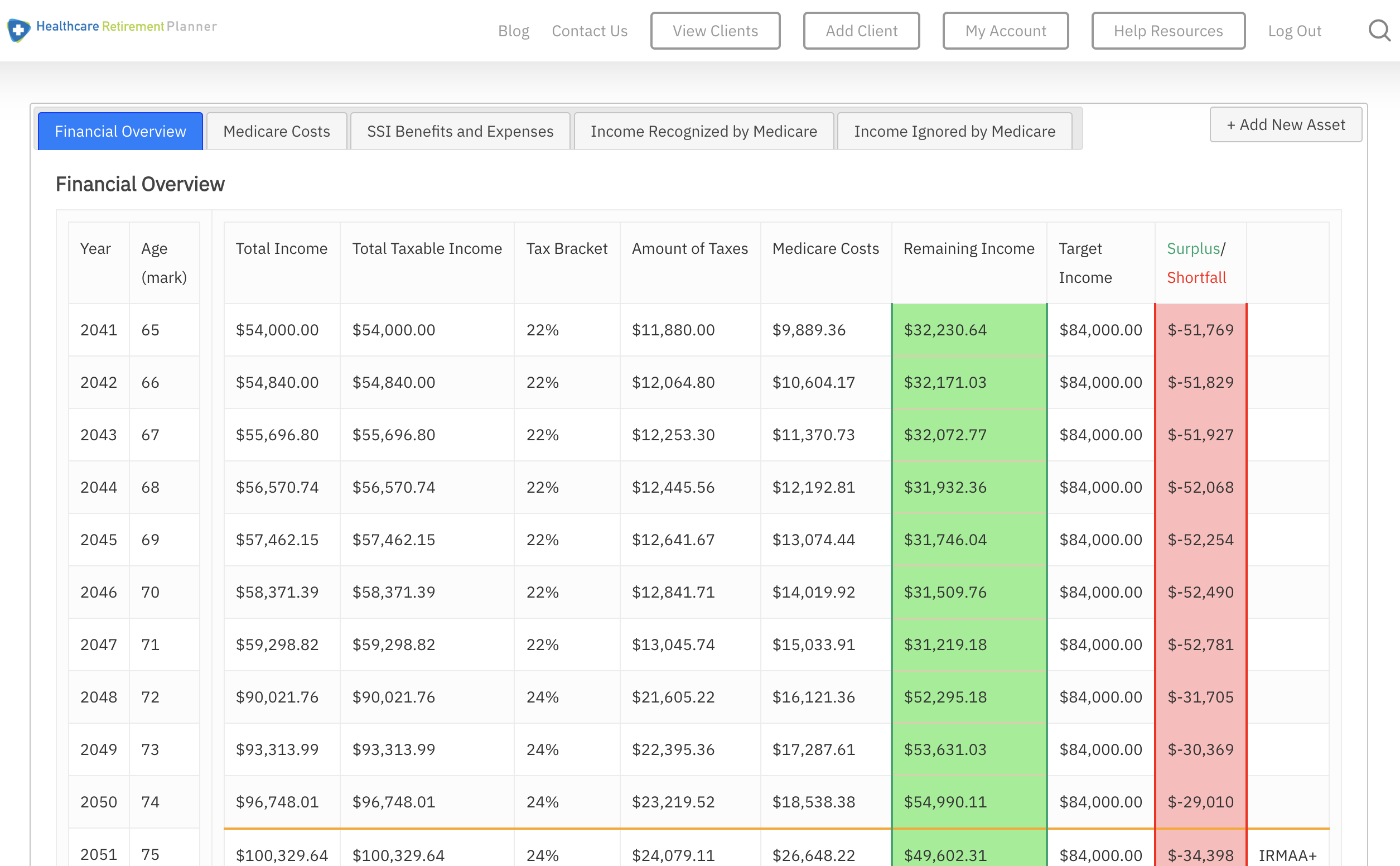

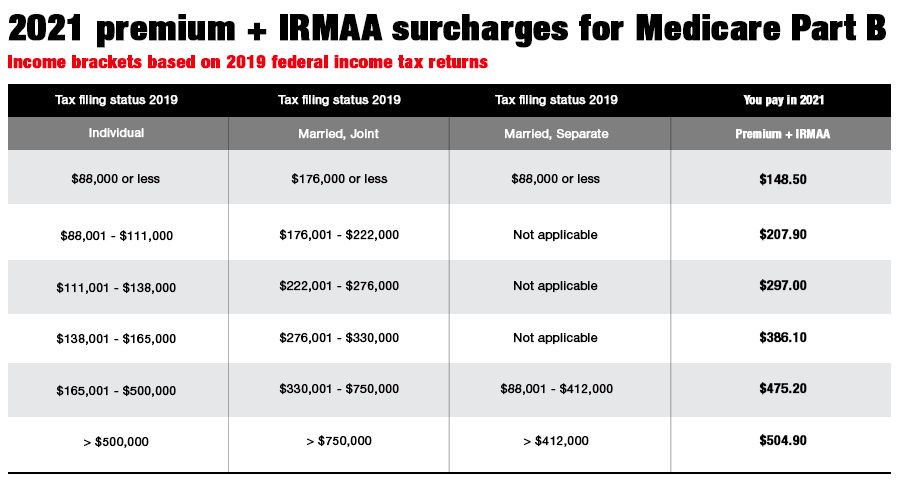

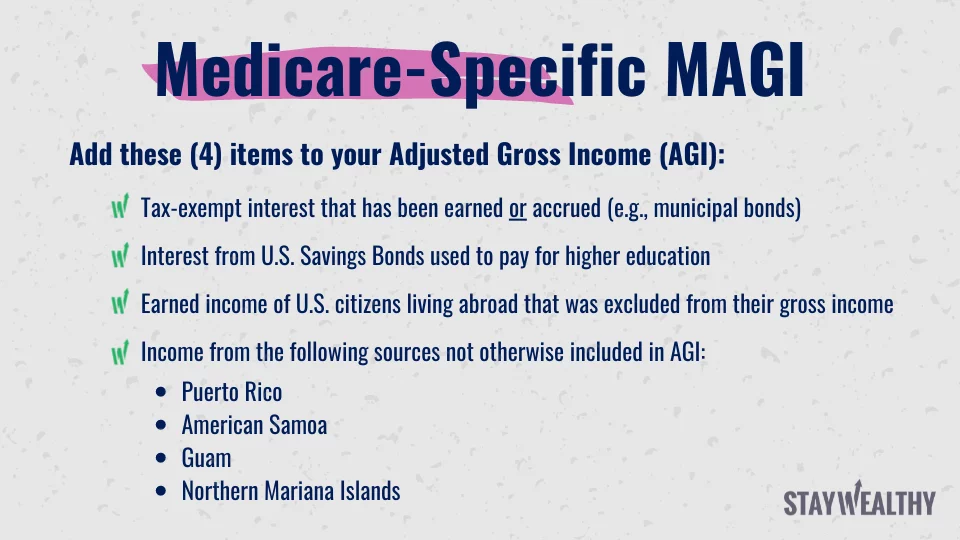

2025 Medicare Surcharge Brackets - Medicare IRMAA 2025 What to Expect for Surcharges in the Coming Year, Monthly medicare premiums for 2025 the standard part b premium for 2025 is $174.70. The medicare irmaa is based on the income on your tax return two years prior. 2025 Medicare Surcharge Brackets. Income threshold and rates from. These are referred to as.

Medicare IRMAA 2025 What to Expect for Surcharges in the Coming Year, Monthly medicare premiums for 2025 the standard part b premium for 2025 is $174.70. The medicare irmaa is based on the income on your tax return two years prior.

Rose Parade Channel 2025. In los angeles the parade will also air. L.a.’s very own […]

What Is the 2025 Medicare Part B Premium and What Are the 2025 IRMAA, Dan mcgrath february 27, 20258 min read. Amounts and how to forecast for retirement.

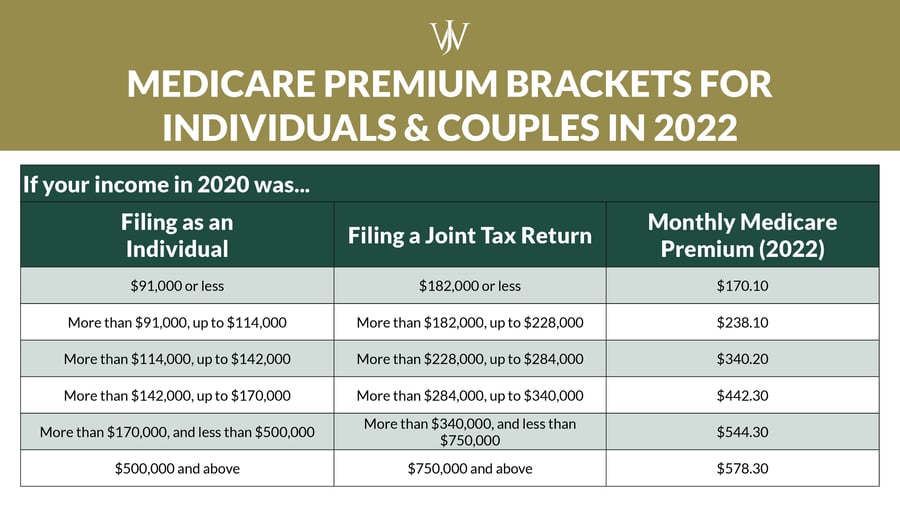

Medicare premiums, surcharges to rise slightly in 2025 InvestmentNews, Average 2025 medicare advantage (ma) premiums and deductibles, among other key information, are released annually in september with the ma & part d. The following charts outline irmaa premium brackets based on income levels and tax filing statuses for medicare part b and part d.

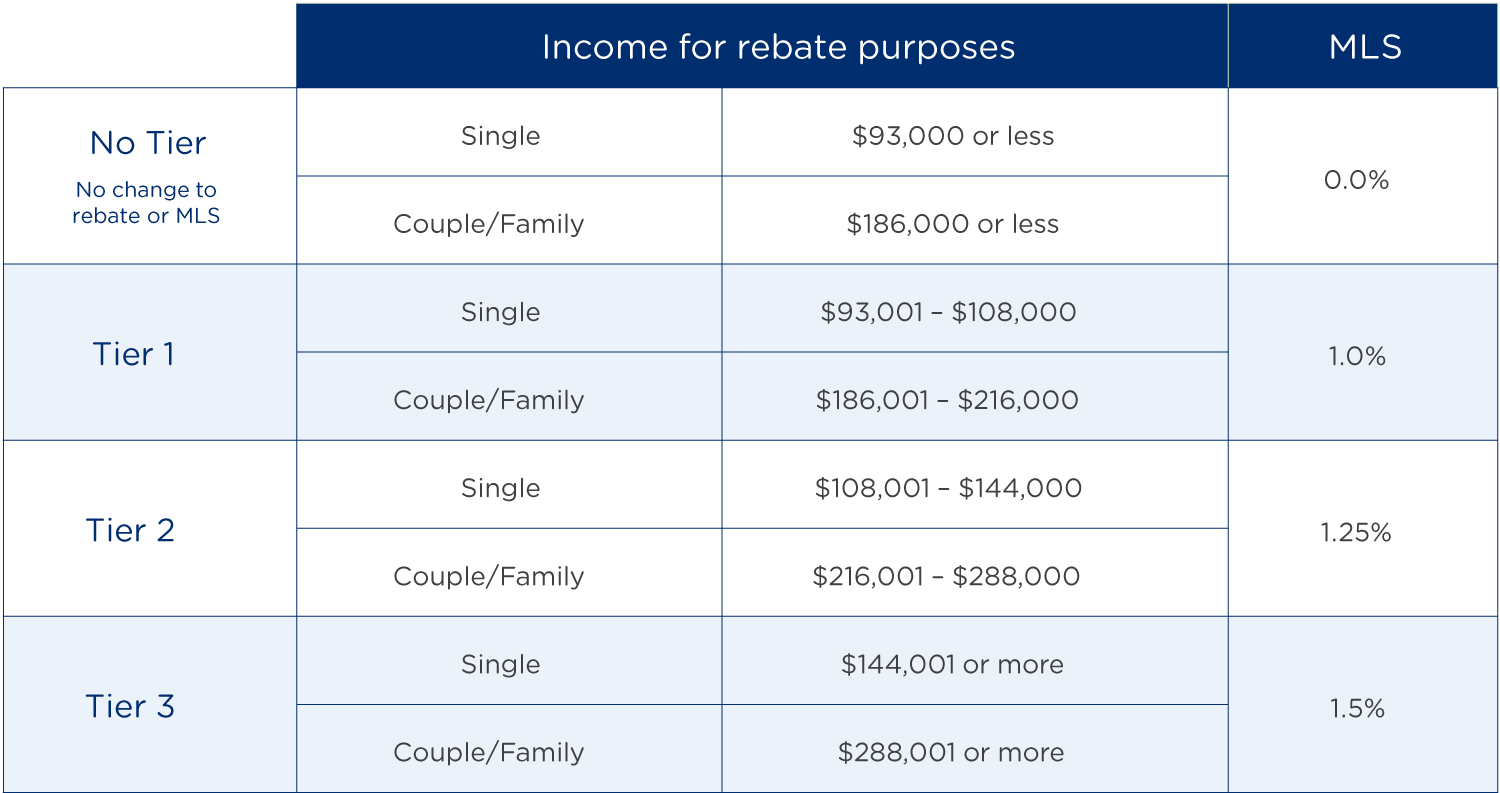

Who Pays the Medicare Levy & Medicare Levy Surcharge?, Within the 1 st irmaa income threshold, the surcharge will only increase by about 5.70% while the highest income threshold for irmaa will increase by over 6.00%. The irmaa income brackets for 2023 start at $97,000 ($103,000 in 2025) for a single person and $194,000 ($206,000 in 2025) for a married couple.

Irmaa Tables For 2025 Maura Nannie, It’s calculated based on your. Up to five tiers of additional surcharges range from $78.10 to $472.00 monthly per person.

Monthly Cost Of Medicare 2025 Benny Cecelia, Understanding the 2025 irmaa brackets: Income brackets and surcharge amounts for part b and part d irmaa.

Chris Brooks Obituary 2025. The albert memorial, on the edge of london's kensington gardens, is […]

Income brackets and surcharge amounts for part b and part d irmaa.

GMIA, Inc. 2023 Part B Costs and IRMAA Brackets, The medicare irmaa is based on the income on your tax return two years prior. The following charts outline irmaa premium brackets based on income levels and tax filing statuses for medicare part b and part d.

The irmaa income brackets for 2023 start at $97,000 ($103,000 in 2025) for a single person and $194,000 ($206,000 in 2025) for a married couple. For 2025, the part b premium is $174.70 and the part d is $55.50.